Bank of America Roth IRAs offer a powerful tool for securing your financial future. This guide delves into the intricacies of this retirement account, exploring its features, benefits, and potential drawbacks. We’ll navigate the process of opening and funding your account, examining the various investment options and tax implications. From understanding contribution limits to crafting effective investment strategies, we’ll equip you with the knowledge to make informed decisions about your retirement savings.

We’ll compare Bank of America’s Roth IRA offerings to those of competitors, highlighting key differences in fees, investment choices, and account management tools. Understanding the nuances of Roth IRAs versus traditional IRAs and 401(k)s is crucial, and we’ll provide clear comparisons to help you determine the best fit for your financial goals. Through illustrative scenarios, we’ll showcase the long-term growth potential of a consistently funded Roth IRA, painting a picture of the financial security it can provide.

Bank of America Roth IRA: A Comprehensive Guide

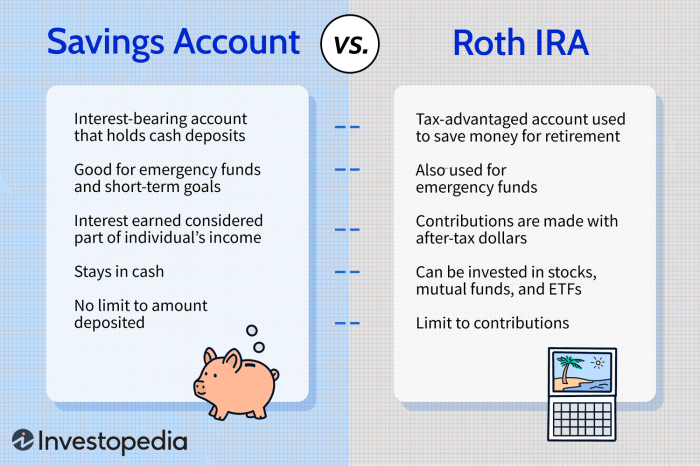

Source: investopedia.com

Navigating the world of retirement planning can feel overwhelming, but understanding the features and benefits of a Roth IRA is a crucial step towards securing your financial future. This guide provides a detailed look at Bank of America’s Roth IRA offering, covering everything from account features and investment options to tax implications and comparisons with other retirement accounts. We’ll explore the process of opening and funding your account, provide practical strategies for managing your investments, and illustrate the long-term growth potential of consistent contributions.

Bank of America Roth IRA Account Features

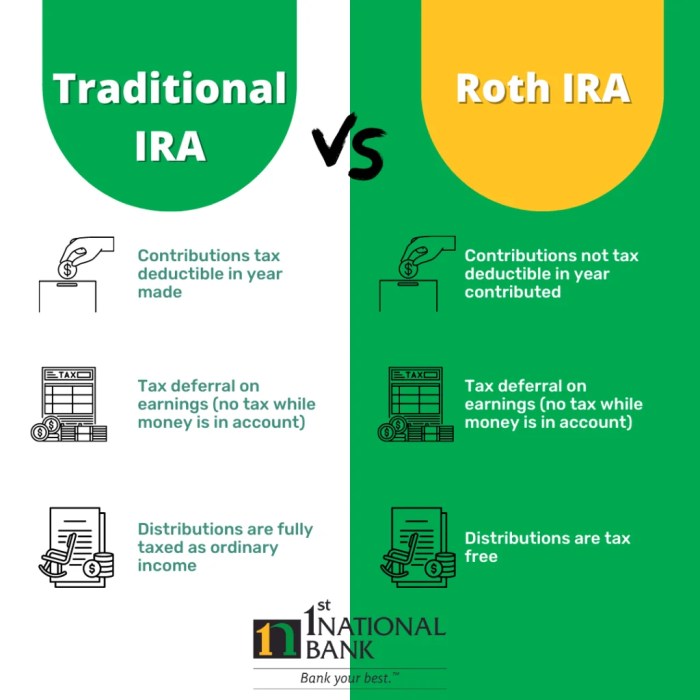

Source: bankwith1st.com

Bank of America offers a range of features designed to simplify Roth IRA management. These features include online account access for easy monitoring and transactions, various investment options to suit different risk tolerances, and educational resources to help you make informed decisions. While Bank of America generally provides competitive fees, it’s crucial to compare them with other institutions to ensure you’re getting the best value.

Investment options span mutual funds, ETFs, and potentially other instruments, providing flexibility in aligning your investments with your financial goals.

Bank of America Roth IRA Fees and Investment Options

Understanding the fee structure and available investment options is vital for maximizing your Roth IRA’s growth potential. Fees can vary depending on the investment choices and account type. It’s important to compare Bank of America’s fees with those of competitors like Fidelity, Schwab, or Vanguard to determine the most cost-effective option. The range of investment choices usually includes mutual funds, ETFs, and potentially individual stocks (depending on the specific account type and platform).

The path to financial enlightenment, like the journey to inner peace, requires mindful choices. While a Bank of America Roth IRA offers a structured approach to wealth building, consider supplementing it with high-yield options. Explore diverse avenues for growth by researching the potential of other institutions, such as checking out cit bank reviews high yield savings , before making your final decisions.

Ultimately, aligning your financial strategy with your spiritual aspirations will lead to true abundance. Remember, your financial journey is a reflection of your inner growth.

| Investment Option | Fees (Example) | Minimum Investment | Risk Level |

|---|---|---|---|

| Mutual Funds (Example: Index Fund) | $5 annual fee (example, may vary) | $1000 (example, may vary) | Low |

| ETFs (Example: S&P 500 ETF) | $0 commission (example, may vary) | $1000 (example, may vary) | Moderate |

| (If available) Self-Directed Brokerage Account | Commission per trade (example, may vary) | $1000 (example, may vary) | High (depending on investments) |

Opening and Funding a Bank of America Roth IRA

Opening a Bank of America Roth IRA is a straightforward process that can be completed entirely online. You will need to provide personal information, choose your investment options, and then fund your account. Several funding methods are available, including electronic transfers from your checking or savings account, rollovers from other retirement accounts, and direct contributions. To maximize your contributions, it is advisable to plan your contributions throughout the year to avoid a last-minute rush.

Funding Methods and Contribution Strategies

Bank of America typically offers various funding methods, including electronic transfers, direct deposits, and potentially checks (although electronic methods are generally preferred for efficiency). To maximize your annual contributions, consider setting up automatic transfers from your checking account. This ensures consistent contributions and helps you reach the maximum contribution limit effortlessly. Remember to consult the current IRS guidelines for the annual contribution limit.

Flowchart: Opening and Funding a Bank of America Roth IRA

The process can be visualized as follows: [

1. Online Application: Provide personal and financial information;

2. Investment Selection: Choose investment options based on risk tolerance and goals;

3. Account Funding: Choose a funding method (electronic transfer, direct deposit, etc.);

4. Confirmation: Review and confirm account details;

5.

Ongoing Contributions: Schedule regular contributions to maximize retirement savings].

Tax Implications of a Bank of America Roth IRA

One of the key advantages of a Roth IRA is its tax-advantaged nature. Contributions are made after tax, meaning you don’t receive an upfront tax deduction. However, qualified withdrawals in retirement are tax-free. Early withdrawals, before age 59 1/2, may be subject to taxes and penalties. Compared to a traditional IRA, where contributions are tax-deductible but withdrawals are taxed in retirement, a Roth IRA offers a different approach to tax planning.

Key Tax Implications of a Roth IRA

- Contributions are made with after-tax dollars.

- Qualified withdrawals in retirement are tax-free.

- Early withdrawals may be subject to taxes and penalties.

- Investment growth is tax-deferred.

Managing and Investing in a Bank of America Roth IRA

Managing your Bank of America Roth IRA is typically done through their online platform. This allows you to monitor your account balance, review investment performance, and make adjustments to your portfolio as needed. Different investment strategies, such as index fund investing, actively managed funds, or a blend of both, are suitable depending on your risk tolerance and financial goals.

Diversification across various asset classes is a key strategy to mitigate risk.

Investment Strategies and Risk Levels

| Investment Strategy | Description | Risk Level | Potential Returns |

|---|---|---|---|

| Index Fund Investing | Investing in a fund that tracks a specific market index (e.g., S&P 500). | Low to Moderate | Moderate |

| Actively Managed Funds | Investing in funds managed by professional fund managers. | Moderate to High | Potentially Higher, but with higher fees and risk |

| Diversified Portfolio | A mix of stocks, bonds, and other asset classes. | Moderate | Moderate to High |

Comparing Bank of America Roth IRA to Other Retirement Accounts

A Roth IRA differs significantly from a traditional IRA and a 401(k) plan. A traditional IRA offers upfront tax deductions but taxes withdrawals in retirement. A 401(k) is employer-sponsored and often offers employer matching contributions, but may have more restrictive withdrawal rules. The best choice depends on your individual circumstances, tax bracket, and retirement goals.

Comparison of Retirement Account Options

| Account Type | Contribution Tax Deduction | Withdrawal Taxation | Contribution Limits | Employer Matching |

|---|---|---|---|---|

| Roth IRA | No | Tax-free (qualified withdrawals) | Annual limit set by IRS | No |

| Traditional IRA | Yes (subject to income limitations) | Taxed in retirement | Annual limit set by IRS | No |

| 401(k) | Pre-tax | Taxed in retirement | Annual limit set by IRS | Often Yes |

Illustrative Scenarios for Bank of America Roth IRA

Several scenarios highlight the benefits of a Bank of America Roth IRA. A young professional starting their career can benefit from the tax-free growth potential over many years. A high-income earner might prefer a Roth IRA to shelter future income from higher tax brackets. Consistent contributions over 30 years, even with modest amounts, can lead to substantial growth due to compounding returns.

Imagine starting with $6,000 annual contributions and achieving an average annual return of 7%. After 30 years, the account could potentially grow to a substantial sum, illustrating the power of long-term investment and compounding.

Wrap-Up: Bank Of America Roth

Securing a comfortable retirement requires careful planning and strategic investment. The Bank of America Roth IRA, with its tax advantages and diverse investment options, presents a compelling avenue for achieving your financial aspirations. By understanding the intricacies of account management, tax implications, and investment strategies, you can harness the power of this retirement vehicle to build a secure financial future.

Remember to consider your individual circumstances and consult with a financial advisor to create a personalized retirement plan that aligns with your goals.