How to open a checking account TD Bank is a straightforward process, yet understanding the various account options, eligibility requirements, and associated fees is crucial for making an informed decision. This guide provides a comprehensive overview of the steps involved in opening a TD Bank checking account, both online and in-person, highlighting the different account types available and addressing common concerns regarding security and account management.

We will explore the necessary documentation, the various customer service options available, and best practices for maintaining the security of your account.

This detailed explanation aims to equip prospective customers with the knowledge needed to navigate the process confidently and select the checking account that best suits their individual financial needs. From understanding eligibility criteria to managing your account effectively, this guide serves as a complete resource for anyone considering opening a checking account with TD Bank.

Eligibility Requirements for a TD Bank Checking Account: How To Open A Checking Account Td Bank

Opening a TD Bank checking account is generally straightforward, but understanding the eligibility requirements beforehand ensures a smooth process. This section details the necessary steps and documentation to get started.

Minimum Age Requirements

Generally, you must be at least 18 years old to open a standard checking account independently at TD Bank. However, some accounts may have exceptions, such as joint accounts where one applicant is of legal age. It’s always best to check directly with TD Bank for the most current and precise age restrictions.

Required Documentation

To open a TD Bank checking account, you’ll need valid identification and proof of address. This verifies your identity and helps prevent fraud.

Acceptable Forms of Identification

TD Bank accepts several forms of identification, including a valid driver’s license, state-issued ID card, passport, or military ID. Ensure the identification is current and hasn’t expired.

Requirements for Individuals Without a Social Security Number

Individuals without a Social Security Number (SSN) may still be able to open a TD Bank checking account, but the process might differ. They will likely need to provide alternative documentation proving their identity and residency. Contacting TD Bank directly is crucial to understand the specific requirements in this situation.

Account Options and Eligibility Criteria

| Account Type | Minimum Age | Required Documentation | Other Requirements |

|---|---|---|---|

| Standard Checking | 18 | Government-issued ID, Proof of Address | None |

| Student Checking | 16-24 (with certain conditions) | Government-issued ID, Proof of Address, Student ID | Proof of enrollment in an educational institution |

| Joint Checking | At least one account holder 18+ | Government-issued ID and Proof of Address for each account holder | None |

Steps to Open a TD Bank Checking Account Online

Opening a TD Bank checking account online is a convenient and efficient option. This section provides a step-by-step guide.

Online Account Creation Process

- Visit the TD Bank website and locate the “Open an Account” section.

- Select the type of checking account you wish to open.

- Provide the necessary personal information, including your name, address, date of birth, and Social Security Number.

- You may be asked to answer security questions to verify your identity.

- Provide information for your initial deposit.

- Review the account terms and conditions and agree to them.

- Submit your application and await confirmation.

Information Required During Online Account Creation

During the online account creation process, you’ll need to provide personal details such as your full name, address, date of birth, Social Security number, and contact information. You will also need to choose a username and password for online account access. Be sure to use a strong, unique password.

Secure Online Account Access and Management

TD Bank employs robust security measures to protect your online account. Always access your account through the official TD Bank website or app, and be cautious of phishing scams.

Setting Up Online Bill Pay

Once your account is open, you can easily set up online bill pay through the TD Bank website or mobile app. This allows you to schedule payments and manage your bills efficiently.

Steps to Open a TD Bank Checking Account In-Person

Opening a checking account in person at a TD Bank branch offers the benefit of immediate assistance from a representative.

In-Person Account Opening Process

Visiting a TD Bank branch requires bringing your valid government-issued ID and proof of address. A bank representative will guide you through the application process and answer any questions you may have.

Documents to Bring to the Branch

Bring your government-issued ID (driver’s license, passport, etc.) and proof of address (utility bill, bank statement, etc.).

Typical Wait Times

Wait times vary depending on the branch and time of day. Expect potential delays during peak hours.

Locating the Nearest TD Bank Branch

Use the TD Bank website’s branch locator to find the nearest branch to your location.

In-Person Account Opening Flowchart

[A flowchart would be visually represented here. It would show the steps: Enter the branch, speak with a representative, provide documentation, complete application, receive account information.]

Different Types of TD Bank Checking Accounts

TD Bank offers various checking accounts to cater to different customer needs and financial situations.

Comparison of TD Bank Checking Accounts

| Account Type | Monthly Fee | Minimum Balance Requirement | Features |

|---|---|---|---|

| Basic Checking | $0-$5 (depending on balance) | $0-$100 (depending on balance) | Debit card, online banking, mobile app |

| Interest Checking | $0 | Variable | Interest earned on balance, debit card, online banking |

| Premier Checking | $25 | $25,000 | Higher interest rates, preferred customer service, additional benefits |

| Student Checking | $0 | $0 | Designed for students, debit card, online banking |

Benefits of Each Account Type

Each account type offers different benefits. Basic checking is ideal for those with minimal banking needs and lower balances, while interest checking and premier checking offer rewards and additional perks for those who maintain higher balances. Student checking accounts are tailored to students’ financial situations.

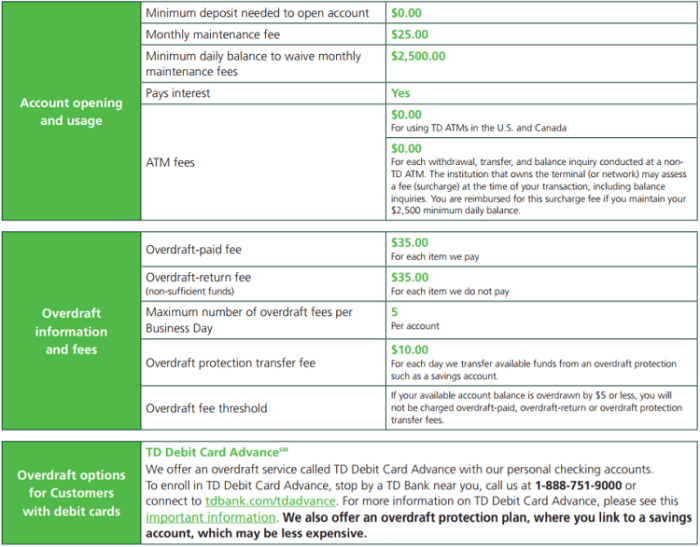

Fees and Charges Associated with TD Bank Checking Accounts

Understanding potential fees associated with your TD Bank checking account helps in budgeting and financial planning.

Potential Fees

Fees may apply for insufficient funds, overdraft protection, monthly maintenance, and other services.

Circumstances Leading to Fees

Fees are typically charged for exceeding your account’s overdraft limit, not maintaining a minimum balance, or using certain services.

Avoiding Unnecessary Fees

Monitor your account balance regularly, maintain sufficient funds, and be aware of any applicable fees.

Summary of Fees

Source: bankdealguy.com

| Fee Type | Description | Amount |

|---|---|---|

| Monthly Maintenance Fee | Fee for maintaining the account | Varies by account type |

| Overdraft Fee | Charged for insufficient funds | Varies |

| ATM Fee (out-of-network) | Fee for using non-TD Bank ATMs | Varies |

Understanding TD Bank’s Customer Service Options

Source: thesmartinvestor.com

TD Bank offers various customer service channels to address your inquiries and concerns.

Customer Service Contact Options

- Phone: Call TD Bank’s customer service number.

- Email: Contact TD Bank through their online customer service portal.

- In-Person: Visit a local TD Bank branch.

Typical Response Times

Phone support typically provides immediate assistance. Email response times may vary. In-person assistance is immediate.

Opening a checking account at TD Bank is straightforward; you’ll need identification and potentially some initial deposit. Understanding your account security is key, so it’s helpful to know that does TD Bank use early warning services to protect against fraud. This information can help you make informed decisions about managing your new TD Bank checking account and its security features.

24/7 Customer Support, How to open a checking account td bank

TD Bank provides 24/7 online banking access, but phone support hours may vary.

Resolving Account-Related Issues

If you encounter account-related issues, contact TD Bank’s customer service using your preferred method.

Security Measures for TD Bank Checking Accounts

TD Bank prioritizes the security of its customers’ accounts through various measures.

Security Measures Employed by TD Bank

TD Bank utilizes encryption technology, fraud monitoring systems, and multi-factor authentication to protect customer accounts.

Identifying and Reporting Suspicious Activity

Report any unauthorized transactions or suspicious activity immediately to TD Bank.

Steps to Take if an Account is Compromised

If your account is compromised, contact TD Bank immediately to report the issue and take steps to secure your account.

Best Practices for Online Banking Security

- Use strong, unique passwords.

- Avoid using public Wi-Fi for online banking.

- Regularly review your account statements.

- Keep your antivirus software up to date.

Managing Your TD Bank Checking Account

Managing your TD Bank checking account efficiently involves various methods for transactions and account access.

Deposit and Withdrawal Methods

Source: thesmartinvestor.com

Deposit and withdraw funds through ATMs, the mobile app, or at a branch.

Accessing Account Statements and Transaction History

Access your account statements and transaction history online or through the mobile app.

Transferring Funds Between Accounts

Transfer funds between your TD Bank accounts conveniently using online banking or the mobile app.

Updating Personal Information

Update your personal information online or at a branch.

Common Account Management Tasks

- Checking account balance

- Paying bills

- Transferring funds

- Viewing transaction history

Last Recap

Opening a TD Bank checking account is a significant step in managing your finances. By understanding the various account options, eligibility requirements, and associated fees, and by utilizing the secure online and in-person banking services offered by TD Bank, you can effectively manage your funds and enjoy the convenience of modern banking. Remember to familiarize yourself with the security measures in place to protect your account and utilize the available customer service channels to address any questions or concerns promptly.

With careful planning and a clear understanding of the process, opening and managing a TD Bank checking account can be a seamless and rewarding experience.